Why you should consider the Hyatt credit card

Max and I are credit card fanatics and are always looking for the next best card to spend our precious dollars on, particularly when it comes to travel expenses. For most of my life, I have not been loyal to a particular hotel brand or airline because I’m generally looking for the best experience at the best price. However, a couple years ago, I signed up for the Chase Hyatt Credit Card to get two free nights at a Hyatt at Lake Tahoe. After doing some math, the $75 fee was more than paid off with my nightly rate of $450 at the Hyatt Regency Lake Tahoe (category 5). Since I got that credit card, its value has only increased for me and it’s still the most-reached-for card in my wallet.

The card got a recent makeover and they’re rolling out the new World of Hyatt card now (UPDATE 07/02/2020: 50K Bonus Points). There are a number of reasons that this card is still in my top 3:

1. The points are incredibly valuable

Have you ever looked at a Hilton points room booking? It’s almost laughable. It can cost you over 100,000 points to book a room at the top tier Hiltons. While I understand that as a member you get some great points bonuses, etc, it’s still difficult to see the value, in my opinion. The Hyatt points system is a whole other story. Hyatt’s most expensive room will cost you 30,000 points. Overall, the points are incredible valuable and it’s easy to rack them up on your credit card. Points Guy values Hyatt points at 1.8 cents a piece, which is a fortune compared to Hilton’s .6 or Marriott’s .9.

Also, as an automatic Discoverist, you’re earning 5 base points and a 10% bonus on eligible purchases, so if you spend a few nights at a Hyatt, you’re earning a significant number of points.

2. Excellent annual free night redemption options

Each year, you get receive a free night certificate to use on a standard room at any hotel up to a category 4 (12,000 points) and you have 12 months to book a room using the certificate. If you’re flexible, there are a number of incredible properties around the world that you can really maximize the value of this free night. Check out our post about our favorite award hotels.

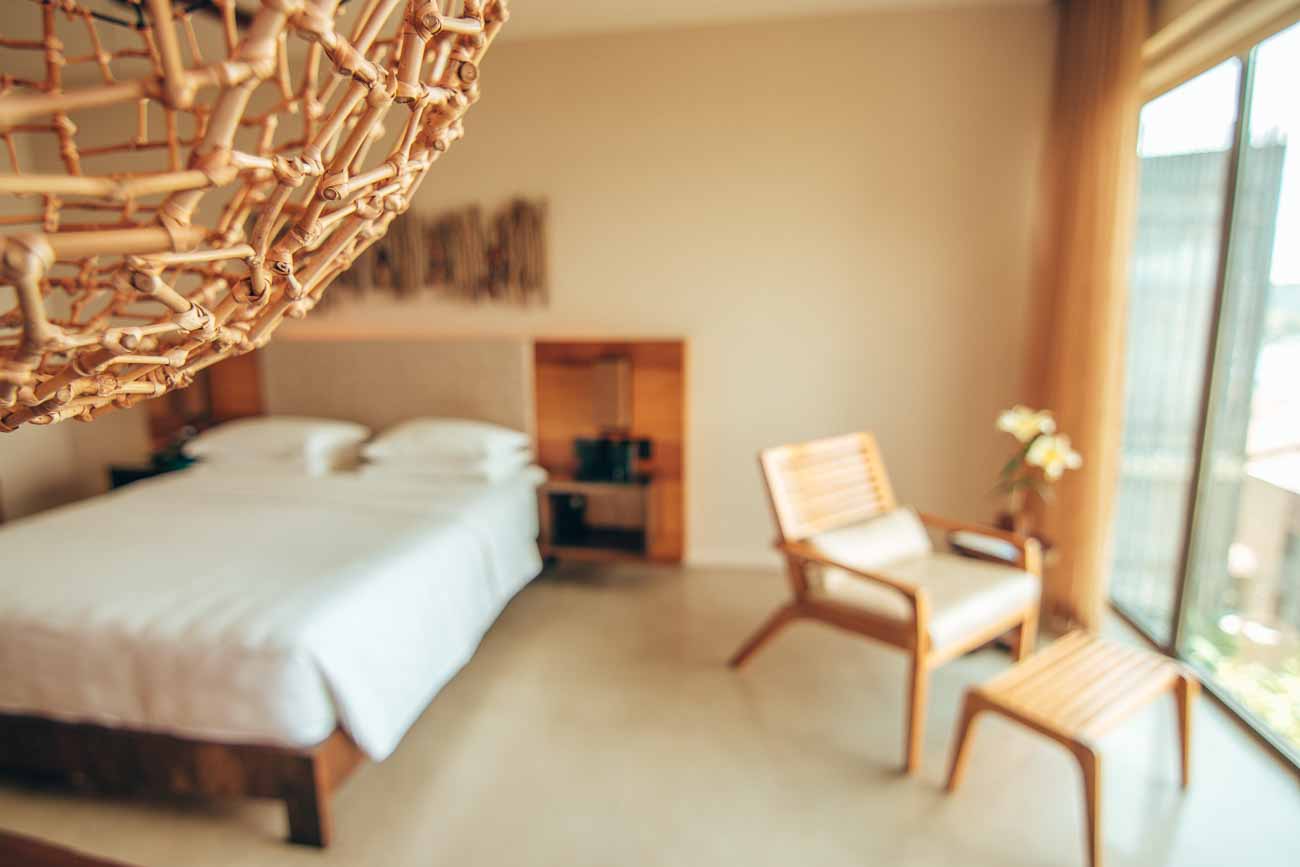

This year, Max and I used our free annual night to book the Andaz Papagayo in Costa Rica, which was an incredible experience [update 2020: The Andaz Papagayo has been upgraded to a Category 5 and is therefore no longer available for the free night usage].

3. Credit card spend categories are great (and now even better!)

The new World of Hyatt card offers the following:

- 4 points per dollar on purchases at Hyatts

- 2 points per dollar at restaurants

- 2 points per dollar on airline tickets purchased directly from airlines

- 2 points per dollar on local transit and commuting, which includes rideshares, taxis, mass transit and tolls

- 2 points per dollar on fitness clubs and gym memberships

- 1 point per dollar on all other purchases

You can easily see how the points can rack up. The addition of the gym membership points bonus is one I have not seen on any of my other cards, including the AmEx platinum and the Chase Sapphire Reserve.

4. Automatic Hyatt “Discoverist” status

The Hyatt credit card gives you automatic Discoverist status, which is Hyatt’s lower tier elite status. Discoverist gives you some nice features like: free bottle of water per night, free premium internet, a “preferred” room in the category booked, 2pm late checkout and dedicated check in lanes. An often forgotten about benefit for me is the waived resort fee on award bookings. This is huge for us as I book a lot of my Hyatt stays on points (due to the amazing credit card points) so not having to shell out the additional $30-50 a night is huge.

Discoverist status also translates to M Life Pearl (MGM’s loyalty program). So if you are going to Las Vegas, you get expedited check in at all MGM properties (which can save you actual hours), as well as free self-parking.

5. The new addition of 20,000 bonus points is a great offer

The sign-up bonus for the Hyatt card is 40,000 points (which can get you two nights in the all-inclusive Hyatt Ziva Los Cabos or 3 nights at Andaz Papagayo), which is already a great sign up bonus. They’re now offering an additional 20,000 points if you spend a total of $6,000 on purchases within the first 6 months of the account opening. Just for opening a new credit card and directing some of your spend to it in the first half year, you will be well on your way to a great vacation, courtesy of your credit card.

There are a number of reasons why this card is still on my top three, but the #1 is that I constantly have more and more points accruing on my account, even just for simple purchases. While this might not be the card for you if you never stay at Hyatt, it can be an extremely valuable card if you’re looking for an easy way to status and benefits…and at least one free vacation.